When Hurricane Katrina ripped through the Gulf Coast in September 2005, leaving death, wreckage, and grief in its wake, Americans were reminded that risk is an integral element of everyday life. Natural disasters are a magnifying glass into popular perceptions of fate and responsibility, and in the aftermath of Katrina, it became clear that most Americans—for all their faith in individualism and personal responsibility—believe that some risks should be viewed as a common problem that can only be effectively addressed through broad cooperative policies of insurance and assistance.

As Hurricane Katrina vividly suggests, risk can bring people together, creating communities of shared fate. Yet risk can also split people apart. Societies have dealt with risk in many ways, and not all of these responses involve public solutions or broad insurance protections. Personal misfortune can be blamed on improvidence and irresponsibility. It can be chalked up to the workings of mystical forces beyond human control. It can be dealt with through private market institutions or through communal frameworks, through localized government action or through the immense powers of the nation state, or through some combination of all these. And, of course, risk does not have to be “dealt with” at all. It can simply be left to individuals and families to cope with, as best they can, on their own.

There is, however, one constant: whether the result of nature or man, whether affecting pocketbooks or personal safety, risk is a social condition. We cannot have risk—the probability of outcomes, good or bad—without variety in the human experience. Risk makes some fortunate and others unfortunate—some rich and others poor, some well and others sick, some able-bodied and others disabled. And because risk creates variety, it also creates the opportunity for social institutions of risk pooling that spread the costs of these unfortunate consequences broadly across affected populations, lessening the burden borne by individuals alone.

Such institutions are by no means foreordained, much less perfectly tailored to circumstances. They are the product of market institutions and political organizations that refract—and sometimes distort—individual preferences and social demands. And ultimately these institutions emerge out of the interpretive meanings that risk-bearers give to their situations. This process of interpretation—how victims of risk see themselves and how others see them—goes a long way toward explaining why some risks are seen as common problems and others as private misfortune, or even as proper comeuppance.

The Social Science Research Council project that is showcased in this web forum is concerned with all these vital issues. Its particular subject, however, is the economic risks facing Americans in the early twenty-first century: where they come from, whether and how they differ from those faced in the past, how people think about them, how governments and the private sector deal with them, and how they can better deal with them in the future.

The title of the project, “The Privatization of Risk” (Hacker 2004), is meant to capture two linked trends in the management of economic risk in the United States. The first is the contemporary celebration of the private sector as the first and best means of dealing with problems of all kinds. This enthusiasm for private-sector solutions is nothing new. In the United States, the belief that private commercial institutions should deal with economic risks goes way back, and is deeply rooted in our political culture and in the framework of social policies that have arisen in our nation (Hacker 2002). Yet today the enthusiasm for the private sector is joined with a sometimes unbridled faith that new technologies and new attitudes have finally “solved” the problems of risk management that once bedeviled private insurers and financial institutions. In this ascendant credo, not only should the private sector manage major risks; it can do it better than it ever has—and, needless to say, better than government ever could.

This brings us to the second trend: the shift of responsibility for managing economic risk from government and employers onto individuals and their families. I have elsewhere called this “The Great Risk Shift” (Hacker 2006), and it is, in my view, the defining economic transformation of our times. The individual management of the economic risks of modern capitalism, whether through private retirement accounts or through personal investments in education and housing, has never been as widespread or as widely celebrated as it is today. Yet with this responsibility has come pressing new questions about the ability of individuals to perceive, plan for, and secure themselves against the most threatening risks to their financial welfare.

The essays that appear on this web forum do not present a single view on these questions. Nor are they of one mind about what should be done. What unites them is a commitment to grapple with a multi-part question at the center of any consideration of America’s economic future: how far has the privatization of risk progressed, why has it taken the direction that it has, and what does it mean for American families?

Just as risk can be a unifying idea in social life, it can be a unifying idea in the social sciences, calling to a single problem the thoughts and inquiries of diverse and distinguished scholars. Already, a growing number of researchers and theorists in a wide range of fields have turned to the concept of risk to illuminate important corners of social, economic, and political life. As chair of the Social Science Research Council’s project on risk privatization, I have worked with Craig Calhoun, president of the Council, to bring together some of the best of these social scientists, legal scholars, and historians to consider and write about their overlapping but distinct concerns. Their essays stand on their own. But they share a common conviction: that careful scholarship can and should speak to society directly and clearly on questions about which non-scholars truly care. The privatization of risk could not be a more appropriate topic for such a discussion.

Growing economic insecurity for American families

Over the past generation, the economic risks faced by American families have increased dramatically, due to linked changes in the workplace and family (Hacker 2004). Yet public programs have largely failed to adapt to these new and newly intensified risks, and private workplace benefits have substantially eroded. As a result, Americans increasingly find themselves on an economic tightrope, without an adequate safety net if—as is ever more likely—they lose their footing. This tightrope does not simply create anxiety about the future and hardship when families lose their fragile balance. It also threatens economic opportunity by making it harder for families to feel sufficiently secure to make the risky investments—in education, housing, retirement savings, and the like—to prosper in a highly dynamic and uncertain economy.

The signs of increased economic insecurity are everywhere. As Elizabeth Warren and Melissa Jacoby explain in their essays, personal bankruptcy rates have risen fivefold in the last quarter century. The mortgage foreclosure rate has increased threefold since the early 1980s (and ninefold since the early 1950s). Rates of job loss are up (Farber 2005), job tenure for men and older workers is down, and skills seem to obsolesce with a speed that defies recent memory. Levels of personal debt are at record levels. And the main forms of household wealth that families now hold—namely, housing and corporate equities—themselves embody substantial (and, arguably, increasing) risk. Meanwhile, employers have shifted from so-called defined-benefit pensions that promise a fixed payment in retirement toward “defined-contribution” pensions, like 401(k) plans, that greatly increase the degree of risk and responsibility placed on individual workers in retirement planning.

For more than a decade, moreover, the number and share of Americans without health insurance have risen with little interruption. Over a two-year period, roughly one in three nonelderly Americans go without coverage at some point (Families USA 2003). Yet not only the uninsured are at financial risk. In 2004, more than 14 million nonelderly Americans paid more than 25 percent of their earnings on out-of-pocket medical costs and health premiums; 10 million of them were insured (Families USA 2004). Medical costs and crises are a factor in nearly half of all personal bankruptcies in the United States, and 80 percent of families bankrupt for medical reasons have health insurance (Himmelstein et al. 2005). Perhaps not surprisingly, poll after poll shows that large majorities of Americans today are pessimistic about the economy and concerned that economic security is slipping away (Newport 2005).

Perhaps the most telling evidence of increased economic insecurity is the growing volatility of family incomes. Along with Nigar Nargis of the University of Dhaka, I have examined the variability of family incomes using the Panel Study of Income Dynamics (PSID), a dataset managed by the University of Michigan that has been tracking a nationally representative group of households since the late 1960s. The PSID data is valuable because most government statistics—such as the unemployment rate, the poverty level, and the distribution of annual income—are “snapshots” that tell us what people are experiencing at a given time, rather than “moving pictures” that reveal what happens to people over a period of several years (Pierson 2004). Because the PSID tracks families over time, it allows us to gain a true dynamic portrait of the up and down trajectory of Americans on the economic ladder over the course of their lives.

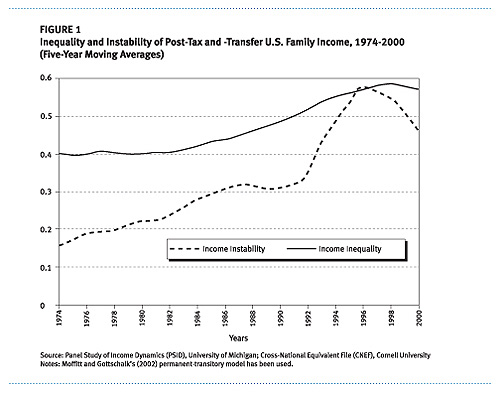

What this picture shows is that families are not merely pulling apart economically—as the well-documented rise in inequality shows. They are also experiencing greater income instability over time. Since the early 1970s, as Figure 1 shows, family incomes in the United States have become much more volatile. Volatility is higher for women than for men, higher for blacks and Hispanics than for whites, and higher for less educated Americans than for more educated Americans. (In all these estimates, family income is adjusted for family size and then distributed equally to adult family members.) Yet volatility has risen across all these groups and, indeed, has risen virtually as quickly among the educated as among the less educated. It has also risen faster than economic inequality over the past generation.

Family income volatility is not itself a measure of economic hardship, just as the volatility of a stock is not itself a measure of economic return. Greater volatility could reflect increased social mobility, or it could represent a largely benign side-effect of rapid increases in family incomes. Unfortunately, neither of these sunny interpretations of rising income volatility is warranted. The extent of social mobility in American society remains a subject of heated dispute, but analysts generally agree that social mobility—whether intergenerational, or over the course of the working life—is no higher today than it was a generation ago, and perhaps lower. Nor does it appear markedly higher in the United States than it does in other advanced industrial nations. Princeton economist Alan Krueger has recently gone so far as to declare: “If the United States stands out in comparison with other countries, it is in having a more static distribution of income across generations with fewer opportunities for advancement.”

On the other hand, family incomes have certainly increased in the United States since the late 1970s—particularly at the top of the economic ladder. Yet in the middle of the economic ladder, the average rise has been surprisingly modest: median family incomes increased by around 15 percent between 1979 and 2000. Furthermore, about three-quarters of the rise in median family incomes, according to Jared Bernstein and Karen Kornbluh, can be accounted for by the increasing work hours of women. Median families are richer, albeit modestly so. But they are richer not principally because employees are earning more, but because they are working more hours than they used to.

Rising economic volatility, in short, is not the result of massively improved social mobility or runaway prosperity for the middle class. Instead, it appears to result from the complex interaction of two profound changes in the economic environment of middle-class families: rising job instability and the transformation of the American family.

Job and family risks

One probable reason for greater volatility of incomes is that the nature of unemployment has changed. The conventional view of unemployment sees it as cyclical: workers are laid off or lose jobs when the economy sours, but are able to return to work at a similar job in the same industry, and sometimes even with the same employer, when the economy improves. Today, however, job loss is increasingly likely to be persistent. Workers are less often able to return to a similar job in a similar industry, and so unemployment frequently ends only when workers accept a new job that requires major cuts in pay, hours, or both.

This trend shows up in a number of places. Although the unemployment rate has remained historically low in recent years, the rate of involuntary job loss (defined as “worker terminations as a result of business decisions unrelated to the performance of the particular employee” (Farber 2005, 13) has actually been rising. In the 2001 recession, the rate of involuntary job loss exceeded the levels reached during the deep downturn of the early 1980s.

The last two recessions of 1990-91 and 2001 have also featured historically high levels of unemployment that exceeds six months. Traditionally, long-term unemployment has peaked six to eight months after a recession ends. In the recession of the early 1990s, however, long-term unemployment peaked 19 months into the recovery. After the 2001 recession, long-term unemployment peaked 29 months in (Schreft and Singh 2003). More than a third of workers involuntarily displaced between 2001 and 2004 (notably, a period of economic recovery) failed to find employment, and 13 percent found only part-time work. And even full-time workers who found full-time jobs—the best-case scenario, if you will—ended up earning around 17 percent less than they would have had they not been displaced (Farber 2005).

A major reason for the divorce between the unemployment and job-loss figures is that many of those displaced from the labor market are not “actively seeking work” and, hence, not formally unemployed. Yet there is good evidence that many of these potential workers would be in the labor force were the opportunities for them greater. In 2005, according to Katharine Bradbury of the Federal Reserve Bank of Boston, the total labor force “shortfall”—compared with similar points in the business cycle in the past—was as high as 5.1 million men and women. This amount would raise the official unemployment rate to 8.7 percent, a level not seen since the steep recession of the early 1980s.

The second major shift that appears responsible for increasing family economic volatility is the transformation of the family—most notably, the dramatic movement of women into the workforce (Warren and Tyagi 2003). This may come as a surprise. Popular commentary portrays two-earner families as islands of stability amid a sea of social uncertainty. Similarly, much of what economists write about the family assumes that the two-earner family serves as a form of private risk-sharing, allowing families to better deal with shocks to income. The analogy is a stock portfolio. Rather than holding a single stock (the husband’s earnings), the two-earner family holds two (the husband’s and wife’s earnings). To paraphrase the old adage of investment, two-earner couples don’t put all their eggs in one basket.

But while two-earner families enjoy special advantages when it comes to private risk-sharing, they can scarcely eliminate economic risk—and in some important ways, two-earner families face special risks of their own. Recall, first of all, that Figure 1 shows that family incomes have grown more variable even as women have entered the workforce in record numbers. Clearly, private risk-sharing has not been sufficient to counter the dramatic increase in family income volatility over the past thirty years.

This is partly because the world has not stood still as women have entered the workforce. In the idealized view of two-earner families, couples “diversify” risk by deciding to jointly enter the workforce and then purchase private substitutes for the previously unpaid labor provided by stay-at-home moms. In reality, the choices of two-earner families have not been as unconstrained as this idealized picture suggests. To most families today, as Elizabeth Warren’s essay drives home, a second income is not a luxury, but a necessity in an era in which wages have been relatively flat and the cost of basic expenses has been rapidly rising. In time-use surveys, both men and women who work long hours indicate they would like to work fewer hours and spend more time with their families—which strongly suggests they are not able to choose the exact mix of work and family they would prefer.

Moreover, although two-earner families are less likely to experience a catastrophic income drop, they are more likely to experience smaller fluctuations in income. After all, if every worker has an equal chance of experiencing a drop in their income, a family with two workers has a substantially greater chance of experiencing an income shock. To be sure, the drop in family income is smaller than it would be if the worker experiencing it were the sole breadwinner. But it is still a more likely occurrence. You may never lose all the eggs when they are in more than one basket, but the likelihood of losing at least some of them is greater.

And all this is to treat these married partners simply as workers, not as parents. Yet because most two-earner partners are raising kids, the tradeoffs posed by work are starker. If both parents work, who stays home when a kid gets sick? If both parents work, what happens to family finances when one leaves the workforce to raise a new baby or care for young children or elderly parents? The standard assumption is that all of these services can be purchased privately—that a sick kid can be cared for by a babysitter, an elderly parent by a nursing home. But the love of a parent or child is not something that can be bought in the marketplace, and in many cases it is nearly impossible to arrange private substitutes for family care. When both parents work, events within the family that require the love and care of family members produce special demands and strains that traditional one-earner families simply did not face.

Finally, women’s movement into the workforce has not just changed the character of parenting; it has also altered the economic relationship between spouses, encouraging greater equality within the household, but also increasing the ability of women to support themselves and children outside of marriage (despite the endurance of a substantial gender gap in earnings). Across the western world, divorce has become more common precisely when and where women’s participation in the labor force has expanded. This is not to suggest that law and culture are immaterial, only that the increased instability of American families has important roots in the expansion of female economic autonomy.

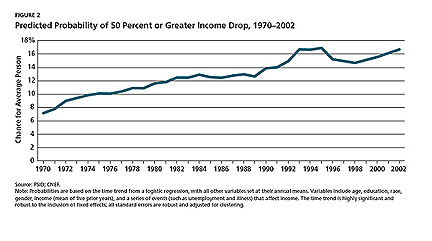

We can get a sense of the serious risks that these twin changes have wrought by looking more specifically at drops in family income. About half of all families in the PSID experience a drop in real income over a two-year period, and the number has remained fairly steady. Yet the median drop—larger than half of drops and smaller than half—has risen from a low of around 25 percent in the 1970s to around 40 percent. To track the trend more precisely, Professor Nargis and I ran a multivariate regression estimating the probability of at least a 50 percent drop in family income. Based on the time trend in the model, we can predict the probability of a 50 percent family income drop when all other variables are held at their means for each year. As Figure 2 shows, the predicted probability of a 50 percent or greater income drop among such“average” families has risen substantially since the beginning of the 1970s.

Public inaction—and private retreat—in the face of rising economic risks

What can be said with certainty is that existing public and private policies are not adequately protecting families against economic instability in a new era of work and family. One revealing piece of evidence is provided by the PSID data discussed earlier: whereas family income drops were substantially cushioned by government taxes and transfers in the 1970s, the cushioning effect of these interventions has declined dramatically. The median drop in family income in the early 1970s was roughly a third smaller than it would have been without taxes and transfers. By the early 2000s, taxes and transfers hardly made a dent in the median drop in family income. To be sure, this may partially reflect the growing role of in-kind benefits, such as health care, which are not included in the PSID. But it seems clear that, at least when it comes to income protection, government is not doing as much as it once did to help families that experience economic shocks.

In part, this may be because U.S. social programs are increasingly focused on workers’ retirement years, rather than on their youth or working lives. In comparative perspective, only Greece and Japan have a greater skew in their public social policies toward cash and services for the aged (Lynch 2000). Though protections for retirees are vital, the growing economic insecurity of younger Americans suggests that there are major gaps in protection for economic risks that affect families during the working years.

At the same time, public programs of social insurance have come under increasing strain. Most notably, unemployment insurance has contracted in reach and generosity during a period when job insecurity has risen. Between 1947 and 1995, the share of workers in covered employment who actually received benefits fell from 80 percent to less than 40 percent (Graetz and Mashaw 1999, 76). The GAO recently reported, in a brief entitled “Unemployment Insurance: Role as a Safety Net for Low-Wage Workers is Limited,” that low-wage workers are particularly unlikely to receive unemployment benefits. In 1995, only about 18 percent of unemployed low-wage workers were collecting benefits (GAO 2000).

Not only is government less involved in risk protection; employers have also cut back many of the generous benefits they once provided as a matter of course. The United States is unique in the extent to which workers rely on employers for basic benefits, like health care and retirement pensions—benefits that in other advanced industrial democracies are provided mostly by government. Indeed, I have shown elsewhere (Hacker 2002) that the American welfare state, with its heavy reliance on tax-subsidized private benefits, is as large as many European welfare states when such benefits and comparative tax burdens are taken into account.

Yet these private forms of risk pooling are in broad decline. Between 1979 and 1998, the share of workers with health insurance coverage from their own employers fell from 66 to 54 percent; among the lowest-paid fifth of workers, the proportion fell from 46 to 26 percent. Retirement pensions, the other major workplace benefit, have likewise declined in reach among lower-paid workers. Yet the major change in pensions is the dramatic shift away from defined-benefit pensions that promise a fixed payment in retirement toward defined-contribution retirement accounts. As recently as twenty years ago, nearly half of workers were covered by a defined-benefit plan. Today, only 20 percent are, and the share continues to fall as the generation covered by such plans retires or dies. Meanwhile, 401(k)s and other defined-contribution plans have gone from nothing to a national obsession. By 2001, nearly 60 percent of families nearing retirement had some money in a defined-contribution pension plan in 1998, up from 11 percent in 1983.

Because defined-contribution plans are essentially private investment accounts sponsored by employers, they greatly increase the degree of risk and responsibility placed on individual workers in retirement planning. Traditional defined-benefit plans are generally mandatory and paid for largely by employers (in lieu of cash wages). They thus represented a form of forced savings. Defined-benefit plans are also insured by the federal government and heavily regulated to protect participants against mismanagement. Perhaps most important, their fixed benefits protect workers against the risk of stock market downturns and the possibility of living longer than expected.

None of this is true of defined-contribution plans. Participation is voluntary, and due to the lack of generous employer contributions, many workers choose not to participate or contribute inadequate sums. Plans are not aggressively regulated to protect against poor asset allocations or corporate or personal mismanagement. The federal government does not insure defined-contribution plans. And defined-contribution accounts provide no inherent protection against asset or longevity risks. Indeed, some features of defined-contribution plans—namely, the ability to borrow against their assets, and the distribution of their accumulated savings as lump-sum payments that must be rolled over into new accounts when workers change jobs—exacerbate the risk that workers will prematurely use retirement savings, leaving inadequate income upon retirement. And, perversely, this risk falls most heavily on younger and less highly paid workers, the very workers most in need of secure retirement protection.

Recent research by Edward Wolff suggests just how serious these shortcomings are. Examining Federal Reserve Board data, Wolff finds that median retirement savings actually declined between 1983 and 1998, despite the massive run-up of the stock market during this period. One cause of the decline was the Social Security reforms of 1983, which lowered guaranteed benefits under the government system. Additionally, however, the value of defined-benefit plans also declined dramatically, as defined-contribution plans became more common. The net effect was not only to lower net retirement wealth, but also to make the distribution of retirement wealth, always relatively unequal, even more skewed in favor of the well off. In 1983, a family with enough wealth to place it at the 99th percentile of the wealth distribution held just over four times as much pension wealth as families in the middle of the wealth distribution. By 1998, they held almost eleven times as much. These trends are likely to be exacerbated as defined-benefit plans, like sediment from a previous era, slowly disappear from the pension landscape.

The problem is not just that older forms of guaranteed insurance in the public and private sectors are slipping away. Perhaps more important, it is that few of America’s strained social programs have been retooled to deal with the new and newly intensified risks to income of the post-industrial, two-earner economy. The current framework of social insurance was constructed in an era in which the key economic risks were seen as a temporary interruption of male wages and inadequate income in retirement. Today, even well-educated workers face a heightened risk of being displaced from employment without prospects for rapid reemployment at comparable levels of earnings, and women are much more likely to be breadwinners than to stay home to care for children. The distinctive risks to family finances created by these shifts are not well insured by present policies.

Acting to preserve opportunity as well as security

Americans, in short, are more economically insecure. And this insecurity not only creates unnecessary hardship for individual workers and their families, it also has serious social costs. The most obvious of these costs are the growing expenses that are picked up by our bankruptcy and social assistance systems and by private relief—none of which are well designed to handle the basic functions of social insurance. Yet there are much larger costs that fall on our economy and our society when families are burdened by excessive economic risk. These include the well-documented psychological dislocations associated with large drops in families’ standards of living—from the blows to mental health caused by job loss to the tensions for families created by downward economic mobility. Importantly, these larger costs also include the reduction of families’ incentives to invest in work, education, parenting, and other foundations of economic advancement when the risks of these investments are not adequately insured against.

Researchers and policymakers have long recognized that policies that encourage risk-taking can benefit society as a whole, because a sufficient number of these risky investments may well pay off. Yet individuals may be unwilling to undertake the investments that involve this level of risk. First, from an individual point of view, the risks of failure may be too high. Second, behavioral research indicates that individuals are highly “loss averse,”meaning they fear losing what they have more than they welcome even substantially larger gains (Kahneman and Tversky 1984). Third, the gains of risky investment may entail positive externalities—that is, benefits that are not exclusive to the individual making the investment, but accrue to others outside the transaction—and thus individuals may not have as much incentive to invest in achieving these gains as they otherwise would.

Many economic investments made by families have this character. And unlike high-rolling investors, who may be used to dealing with large losses and to seeing their present holdings as merely means to further ends, families are likely to see many of their investments or their payoffs as intrinsically valuable components of their basic endowments—and, hence, as something they acutely fear losing.

Owning a home, for example, is beneficial to families and society. But it entails substantial financial risk (Shiller 2005). As families have bid up home prices in areas with good schools and strong communities (Warren and Tyagi 2003), more and more of family finances are tied up in risky home investments. Similarly, education—and particularly education of children—is an investment that pays off handsomely. But the returns to education are highly variable, and there is evidence they are becoming more so (Bernhardt et al. 1999; Farber 2005). Moreover, parents who invest in raising productive children do not reap many direct economic benefits, as they once did when children contributed to household production. The costs of investing in children are immediate and direct, the gains are long-term and societal. In short, the wellsprings of economic opportunity assets, education, good parenting—are high-risk investments, often with positive externalities.

Unique among social institutions, government can encourage such investments. It has the means—and, often, the incentive—to require participation in broader risk pools and to foster positive externalities that no private actor sufficiently gains from to encourage individually. This is a major reason why government has long played a central role in managing risk in the private sector (Moss 2002). Corporate law has long recognized the need to limit the downside of risk-taking as a way of encouraging firms to take a socially appropriate amount of risk. The law of bankruptcy and the principle of limited liability—the notion that those who run a firm are not personally liable if the firm fails—allow entrepreneurs to engage in risky investments knowing that they will not be forced into penury or debt servitude if their risky bets fail. Deposit insurance increases the likelihood of savings and decreases the possibility of devastating bank runs, by allowing depositors to feel secure that they can obtain their money when they need it.

A similar logic holds for ordinary Americans. When workers and families are faced with fateful economic choices that place them at grave risk—about, for instance, the level of education to get or whether to retrain for new jobs—they may be unwilling to take the socially desired level of risk. As a result, more people choose the safe option, rather than the option that represents a socially desirable level of risk-taking. By providing basic security for families faced with these decisions—not complete protection, but a floor below which they are prevented from falling—government improves not only their own standing and opportunities, but also social welfare more generally.

This argument is not merely analogical. A growing body of evidence backs it up. Comparative statistics indicate, for example, that generous personal bankruptcy laws are associated with higher levels of venture capital (Armour and Cumming 2004). Research on labor markets shows that workers who are highly fearful of losing their job invest less in their jobs and job skills than those who are more secure (Osberg 1998). And cross-national studies suggest that investment in education and job skills is higher when workers have key risk protections (Esteves-Abe, Iversen, and Soskice 2001; Mocetti 2004).

This last finding, which may surprise those weaned on the view of social insurance as an inevitable drag on the economy, is perhaps the most telling. Workers, it seems, invest in highly specific assets—such as skills that do not transfer easily from one firm or occupation to another—only when the risk of losing the potential returns of those assets are mitigated by basic insurance protections that are not job-specific. When insurance is not present, workers under-invest in the most crucial asset in most families’ portfolio—namely, the value of family members’ human capital (see also Neal 1995).

In short, a foundation of social insurance is not merely critical to providing economic security. It is also critical to ensuring economic opportunity and advancement in a dynamic economy. Social insurance protects families when they “fall from grace” (Newman 1999), and for this it should be welcomed. But it also encourages families that do not experience misfortune to make investments that benefit them and society, and for this it should be celebrated. Social insurance is about efficiency and growth as well as equality and justice (Barr 1998).

Jacob S. Hacker is Peter Strauss Family Associate Professor in the Department of Political Science at Yale University.

References

Armour, John and Douglas Cumming (2004), “The Legal Road to Replicating Silicon Valley,” paper read at Babson Entrepreneurship Conference, Glasgow, Scotland.

Barr, Nicholas (1998), The Economics of the Welfare State, 3rd ed, Oxford, Oxford University Press.

Bernhardt, Annette, Martina Morris, Mark S. Handcock and Mark A. Scott (1999),“Trends in Job Instability and Wages for Young Adult Men,” Journal of Labor Economics 17 (4).

Esteves-Abe, Margarita, Torben Iversen and David Soskice (2001), “Social Protection and the Formation of Skills: A Reinterpretation of the Welfare State,” in P. Pierson (ed.), The New Politics of the Welfare State, New York, Oxford University Press.

Families USA (2003), “Going without Health Insurance,” Washington, D.C., Families USA Foundation.

Families USA (2004), “Health Care: Are You Better Off Today Than You Were Four Years Ago?” Washington, D.C., Families USA Foundation.

Farber, Henry (2005), “What Do We Know about Job Loss in the United States?”Federal Reserve Bank of Chicago 2Q: 13-28.

GAO (2000), “Unemployment Insurance: Role as Safety Net for Low Wage Workers is Limited,” United States General Accounting Office.

Graetz, Michael J. and Jerry L. Mashaw (1999), True Security: Rethinking American Social Insurance, New Haven, CT, Yale University Press.

Hacker, Jacob S. (2002), The Divided Welfare State: The Battle over Public and Private Social Benefits in the United States, New York, Cambridge University Press.

_____ (2004), “Privatizing Risk without Privatizing the Welfare State: The Hidden Politics of Social Policy Retrenchment in the United States,” American Political Science Review 98 (2).

_____ (2006), The Great Risk Shift: The New Economic Insecurity—And What Can Be Done About It, New York, Oxford University Press.

Himmelstein, David U., Elizabeth Warren, Deborah Thorne and Steffie Woolhandler (2005), “MarketWatch: Illness And Injury As Contributors To Bankruptcy,” Health Affairs Web Exclusive.

Jacoby, Melissa B. (2005), “Identifying and Managing Household Risk: Lessons from Bankruptcy,” http://privatizationofrisk.ssrc.org/Jacoby/.

Kahneman, Daniel and Amos Tversky (1984), “Choices, Values, and Frames,” American Psychologist 39.

Lynch, Julia (2000), “The Age Orientation of Social Policy Regimes in OECD Countries,” Journal of Social Policy 30 (2).

Mocetti, Sauro (2004), “Social Protection and Human Capital: Test of a Hypothesis,” Department of Economics, University of Siena.

Moffitt, Robert and Peter Gottschalk (2002), “Trends in the Transitory Variance of Earnings in the United States,” Economic Journal, March.

Moss, David A. (2002), When All Else Fails: Government as the Ultimate Risk Manager, Cambridge, MA, Harvard University Press.

Neal, Derek (1995), “Industry-Specific Human Capital: Evidence from Displaced Workers,” Journal of Labor Economics 13 (4).

Newman, Katherine S. (1999), Falling from Grace: Downward Mobility in an Age of Affluence, 2nd ed, Berkeley, CA, University of California Press.

Newport, Frank (2005), “Americans’ Dour Economic Attitudes Little Affected by Katrina; Americans very negative on economy both before and after hurricane,” in Gallup Report.

Osberg, Lars (1998), “Economic Insecurity,” discussion paper, Sydney, Australia, Social Policy Research Centre.

Pierson, Paul (2004), Politics in Time, Princeton, Princeton University Press.

Schreft, Stacey and Aarti Singh (2003), “A Closer Look at Jobless Recoveries,” Federal Reserve Bank of Kansas City 2Q.

Shiller, Robert J. (2005), Irrational Exuberance, 2nd ed, Princeton, N.J., Princeton University Press.

Warren, Elizabeth (2005), “Families, Money and Risk,” http://privatizationofrisk.ssrc.org/Warren/.

Warren, Elizabeth and Amelia Warren Tyagi (2003), The Two-Income Trap: Why Middle-Class Mothers and Fathers Are Going Broke (With Surprising Solutions That Will Change Our Children’s Futures), New York, Basic Books.